Deals, Development, and Acquisitions

In 2022, BV Capital provided a variety of investment opportunities across different real estate classes in multiple markets across the nation. These included Land/Pre-Development, Medical Development, Industrial, 1031/DSTs, and Multifamily Offerings.

2022 was a year of firsts for us at BV Capital. Take a detailed look at our new offerings and view what's coming next below.

Our First Delaware Statutory Trust Acquisition

BV Capital worked with Bridgeview to close on our first DST the 'Dunhill Apartments' in April 2022. Located within 1 mile of the Dallas Uptown District, the most expensive submarket in all of the DFW metroplex.

Following the sale, BV Capital went to work on raising the $31M in 1031 equity through broker dealers and RIAs and the BV Construction Team began their work on a $3M value-add renovation. The DST raise only has $2M in available equity left.

Our First Delaware Statutory Trust Acquisition

BV Capital worked with Bridgeview to close on our first DST the 'Dunhill Apartments' in April 2022. Located within 1 mile of the Dallas Uptown District, the most expensive submarket in all of the DFW metroplex.

Following the sale, BV Capital went to work on raising the $31M in 1031 equity through broker dealers and RIAs and the BV Construction Team began their work on a $3M value-add renovation. The DST raise only has $2M in available equity left.

Our First Entrance into a Non-Texas Market

BV Vibra - Medical Development

BV Capital officially moved into a non-Texas market with our acquisition of a new build, neuro-rehab hospital in Sacramento, California.

We closed on the property with our land investors in September 2022, and moved to swiftly finalize the development in order for the tenant, Vibra Hospital, to begin their lease as soon as possible. Construction is now complete and we plan on selling the property or recapitalizing it into a DST before the end of Q1 2023.

Our First Entrance into a Non-Texas Market

BV Vibra - Medical Development

BV Capital officially moved into a non-Texas market with our acquisition of a new build, neuro-rehab hospital in Sacramento, California.

We closed on the property with our land investors in September 2022, and moved to swiftly finalize the development in order for the tenant, Vibra Hospital, to begin their lease as soon as possible. Construction is now complete and we plan on selling the property or recapitalizing it into a DST before the end of Q1 2023.

Our Largest Land/Predevelopment Offerings to Date:

BV Capital enhanced it's presence in the Gulf of Mexico to close on this 127-acre tract of land in October 2022. This land acquisition marks the beginning of a master plan development called 'Barisi Village' that will be developed jointly with Blackard Companies. Our goal is to develop a mixed-use village concept incorporating multiple developments over 6 phases.

Our Largest Land/Predevelopment Offerings to Date:

BV Capital enhanced it's presence in the Gulf of Mexico to close on this 127-acre tract of land in October 2022. This land acquisition marks the beginning of a master plan development called 'Barisi Village' that will be developed jointly with Blackard Companies. Our goal is to develop a mixed-use village concept incorporating multiple developments over 6 phases.

BV Capital continued to pursue additional land throughout 2022 by purchasing an adjacent 40 acres of land next to our 2021 land acquisition. We officially closed with land investors in June 2022, giving the deal a combined 140 acres of land in west Galveston for a future vacation home development.

BV Capital continued to pursue additional land throughout 2022 by purchasing an adjacent 40 acres of land next to our 2021 land acquisition. We officially closed with land investors in June 2022, giving the deal a combined 140 acres of land in west Galveston for a future vacation home development.

FEATURED DEAL - NOW OPEN

BV Denton II land will consist of land acquisition and all pre-development work needed to break ground on the construction phase. Bridgeview is looking to acquire 22.05 acres for the construction a 360-unit multifamily project directly adjacent to another Bridgeview sister property, Forest Crossing in Denton, TX.

Bridgeview began construction on Phase I in January 2023, and we are aiming to bring synergies to both the construction and the property management process across the life of this offering.

*The Preferred Return is not guaranteed as it relies on the performance of the Fund and the underlying assets.

FEATURED DEAL - NOW OPEN

BV Denton II land will consist of land acquisition and all pre-development work needed to break ground on the construction phase. Bridgeview is looking to acquire 22.05 acres for the construction a 360-unit multifamily project directly adjacent to another Bridgeview sister property, Forest Crossing in Denton, TX.

Bridgeview began construction on Phase I in January 2023, and we are aiming to bring synergies to both the construction and the property management process across the life of this offering.

*The Preferred Return is not guaranteed as it relies on the performance of the Fund and the underlying assets.

FEATURED DEAL - NOW OPEN

BV Denton II land will consist of land acquisition and all pre-development work needed to break ground on the construction phase. Bridgeview is looking to acquire 22.05 acres for the construction a 360-unit multifamily project directly adjacent to another Bridgeview sister property, Forest Crossing in Denton, TX.

Bridgeview began construction on Phase I in January 2023, and we are aiming to bring synergies to both the construction and the property management process across the life of this offering.

*The Preferred Return is not guaranteed as it relies on the performance of the Fund and the underlying assets.

The Fund now owns 7 assets with the acquisition of an industrial facility in Arlington, TX in August 2022, with Grainger as the anchor tenant. The Fund is still open to new investment but is in the final acquisition stage and will be closing to new money later this year.

*The Preferred Return is not guaranteed as it relies on the performance of the Fund and the underlying assets.

The Fund now owns 7 assets with the acquisition of an industrial facility in Arlington, TX in August 2022, with Grainger as the anchor tenant. The Fund is still open to new investment but is in the final acquisition stage and will be closing to new money later this year.

Updates on Ongoing Deals

Throughout the year, BV has continued work on our current offerings to continue to bring value to both our investors and the communities we work in.

Updates on Ongoing Deals

Throughout the year, BV has continued work on our current offerings to continue to bring value to both our investors and the communities we work in.

Updates on Ongoing Deals

Throughout the year, BV has continued work on our current offerings to continue to bring value to both our investors and the communities we work in.

A look into Bridgeview Events

BV held 3 Investor Events in 2022, taking place in Dallas, Austin & Houston.

Pictured here are Dru Guillot and Steve May who along with Jack Roberts (not pictured) run the development team at Bridgeview. And BV Capital President, Rob Anderson, is pictured presenting to our investors in Houston.

Outside of Texas, BV Capital attended the MoneyShow event in Orlando, FL. Pictured at our booth: Sharla Langston, Rob Anderson, and Cade Snowden from our team.

*The information contained herein does not constitute an offer to sell nor is it a solicitation of an offer to purchase a security. Offers will only be made through a private placement memorandum to accredited investors and where permitted by law. The preferred return is not guaranteed as it relies on the asset's performance. Past performance may not be indicative of future results.

A look into Bridgeview Events

BV held 3 Investor Events in 2022, taking place in Dallas, Austin & Houston.

Pictured here are Dru Guillot and Steve May who along with Jack Roberts (not pictured) run the development team at Bridgeview. And BV Capital President, Rob Anderson, is pictured presenting to our investors in Houston.

Outside of Texas, BV Capital attended the MoneyShow event in Orlando, FL. Pictured at our booth: Sharla Langston, Rob Anderson, and Cade Snowden from our team.

A look into Bridgeview Events

BV held 3 Investor Events in 2022, taking place in Dallas, Austin & Houston.

Pictured here are Dru Guillot and Steve May who along with Jack Roberts (not pictured) run the development team at Bridgeview. And BV Capital President, Rob Anderson, is pictured presenting to our investors in Houston.

Outside of Texas, BV Capital attended the MoneyShow event in Orlando, FL. Pictured at our booth: Sharla Langston, Rob Anderson, and Cade Snowden from our team.

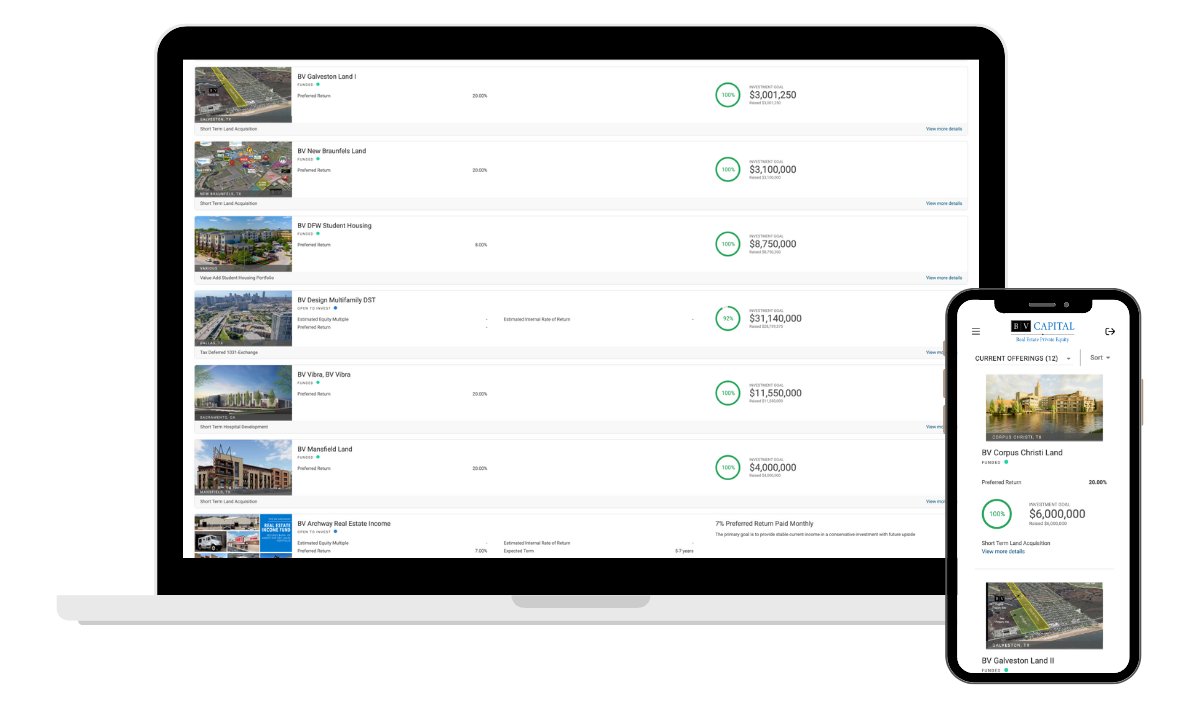

Want more details on the projects mentioned above? Check out BV Capital's Investor Portal.

Our Investor Portal provides you with comprehensive deal information and other exclusive content only available to our approved contacts. You do not need to be a current investor to have a BV account with us. We are committed to providing you with all the tools needed to make investing with BV Capital easy. If you haven't done so already, you can create your account here.

Want more details on the projects mentioned above? Check out BV Capital's Investor Portal.

Our Investor Portal provides you with comprehensive deal information and other exclusive content only available to our approved contacts. You do not need to be a current investor to have a BV account with us. We are committed to providing you with all the tools needed to make investing with BV Capital easy. If you haven't done so already, you can create your account here.