BV Corpus Christi

On behalf of Bridgeview Multifamily, BV Capital raised limited partnership equity of $6,000,000 in Fall 2022 to facilitate the acquisition of 127 acres for a mixed-use project in Corpus Christi, TX.

The property is located next to the Texas A&M Corpus Christi campus near Corpus Christi Bay. Bridgeview's goal is to develop a series of multifamily, senior living, single family, commercial (including office), retail and hospitality use projects.

127 Acre Mixed Use Development - Phase One Land Investment

The land acquisition marks the beginning of a master plan development, called Barisi Village (Barisi), that Bridgeview will partner with Blackard Companies (Blackard) to develop along one of the arteries in a key Corpus Christi submarket. Phase One is planned to include a five-story, mixed-use project containing approximately +/- 268 multifamily units, ~30,000 square feet of retail, ~2,400 square feet of executive offices, a parking garage and a village center with a bell tower and piazza. The Phase One proposed development design will be based on Blackard's proprietary village-based philosophy.

Investors will receive a preferred return of 20%, calculated on an annualized basis. The time between investment in the land acquisition and construction breaking ground on Phase One of the development is estimated to be between twelve and fifteen months. The land acquisition closed on October 27th, 2022. The construction phase is expected to be fully funded and breaking ground in Q3 or Q4 of 2023 which is when the recapitalization of the land investment will occur.

In the event that the recapitalization closes quicker, Investors will receive a minimum preferred return of 12%. If the recapitalization takes longer than approximately seven months, the accrued preferred return will exceed the minimum.

- 20% Preferred Return accruing on an annual basis

- 12%* Minimum Preferred Return if investment is closed out prior to month seven

- Investor payout occurs once the recapitalization from land phase to development phase is completed within the stated timeframe

Investors will have the option to have their investment and gain returned at recapitalization or roll all or a portion of their funds into the full construction project offering that is projected to break-ground Q3 or Q4 of 2023. Any funds rolled into the construction project would be done in a way that seeks to minimize and/or avoid tax consequences for the exchange.

BARISI VILLAGE SITE MAP

*The Preferred Return is not guaranteed as it relies on the performance of the Fund and the underlying assets.

Corpus Christi, TX

Corpus Christi is a coastal city with a strong industrial base and skilled workforce. Companies like CITGO and Valero tap into an existing talent pool that is bolstered by area colleges like Del Mar College and Texas A&M University-Corpus Christi. The nation’s fifth largest port, a connected highway network, and rail and air service help companies move their goods, ideas and people between Corpus Christi and major markets across the United States in a convenient and cost-effective way. More than $70 billion in new business investment has been announced between 2009 and 2019 as Corpus Christi continues to be a hub in South Texas’ economy.

The rental market in Corpus Christi, and specifically the Bay Area, is made up largely of smaller rental properties and older B class and marginal A class 150+ unit properties. Rents have been consistent through the pandemic and subsequent recovery, due in part to the industrial growth and continued shortage of housing in the PMA.

According to Axiometrics, the Corpus Christi apartment market occupancy was 95.0% as of the end of December 2021, which represents a 1.3% positive change over last year.In addition to the positive absorption, Corpus Christi was able to achieve an average effective rent of $1,093, representing 7.8% average effective rent growth over the prior year. The Corpus Christi market is forecasted to experience effective rent growth of 3.6% over the next four years starting with 4.5% growth in 2022.

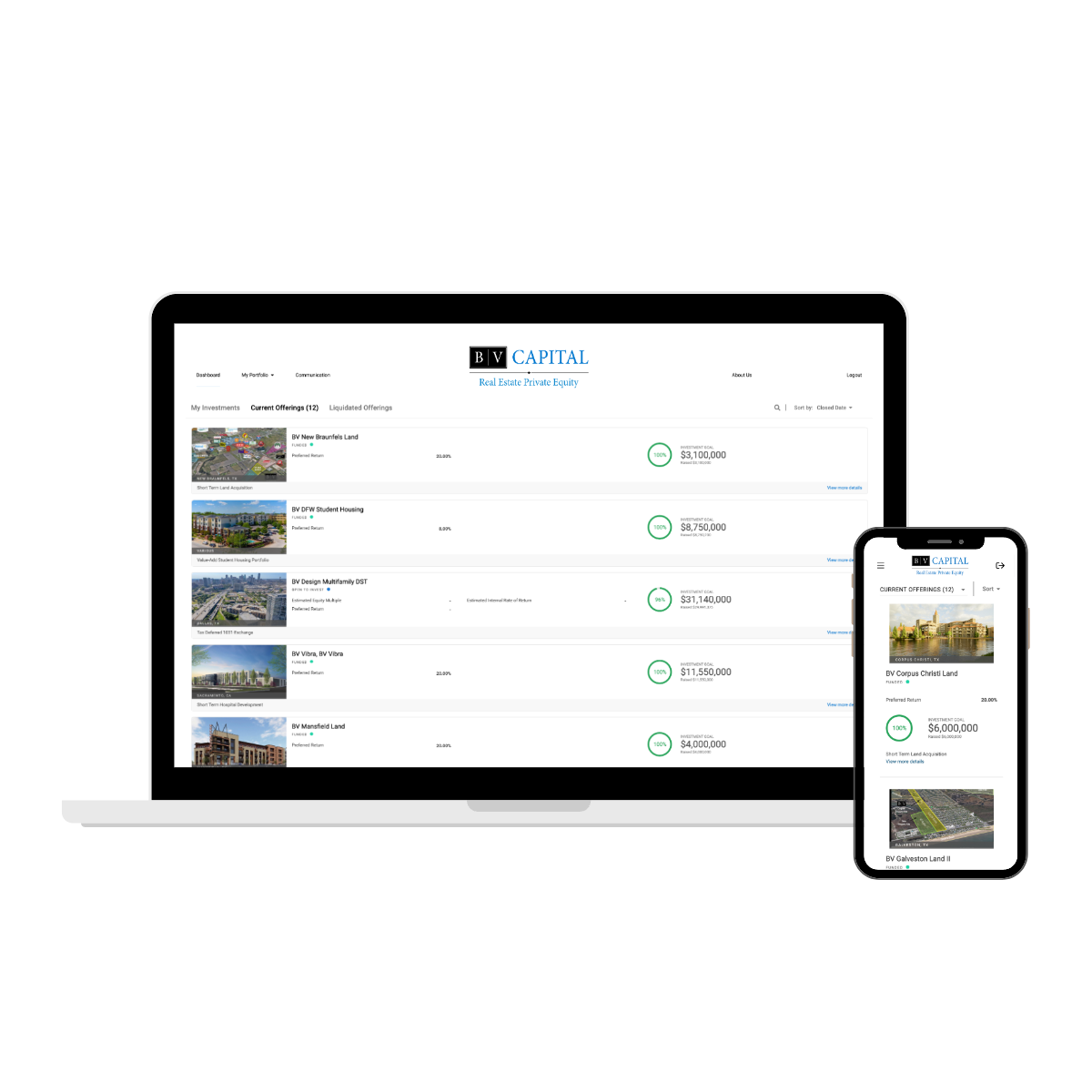

Are you ready to take the next step?

Our Investor Portal provides you with comprehensive deal information and other exclusive content only available to our approved contacts. Create an account below to view all our current and past deals.