A 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. The term comes from the Internal Revenue Service (IRS) code Section 1031. A The properties being exchanged must be considered like-kind in the eyes of the IRS for capital gains taxes to be deferred. If used correctly, there is no limit on how many times or how frequently you can do 1031 exchanges.

Images of Portfolio Properties

delaware statutory trust: 1031 EXCHANGE

BV Student Housing Texas Portfolio DST

The BV Student Housing Texas Portfolio DST is an opportunity for Investors seeking to participate in a Section 1031 Exchange and for cash investors seeking cash flow and appreciation potential.

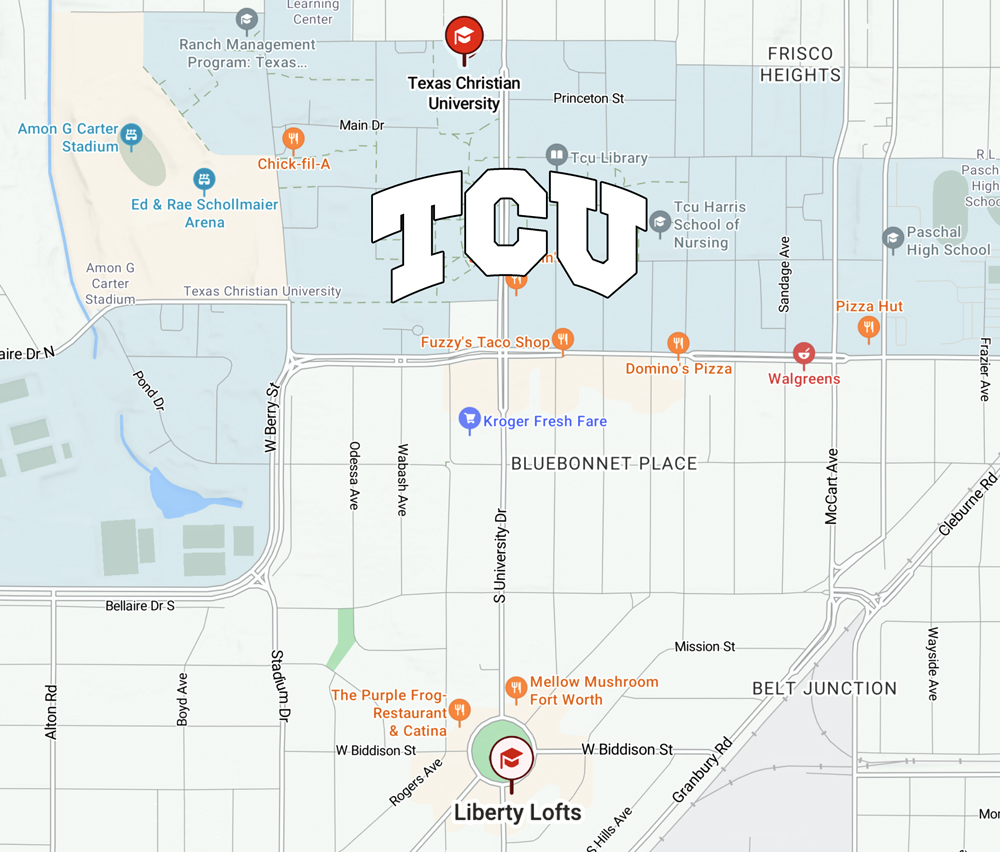

The portfolio consists of two stabilized student housing properties, "Liberty Lofts" at Texas Christian University (TCU) in Fort Worth, TX and "Midtown Urban" at The University of Texas at Arlington (UTA) in Arlington, TX.

BV investment PORTFOLIO HIGHLIGHTS:

$27M

Equity raise

41.44%

Offering LTV

5.30%

fixed Loan rate

DELAWARE STATUTORY TRUST: 1031 EXCHANGE

BV Student Housing Texas Portfolio DST

$27M

Equity raise

41.44%

Offering LTV

5.30%

Loan rate

The BV Student Housing Texas Portfolio DST is an opportunity for Investors seeking to participate in a Section 1031 Exchange and for cash investors seeking cash flow and appreciation potential.

The portfolio consists of two stabilized student housing properties, "Liberty Lofts" at Texas Christian University (TCU) in Fort Worth, TX and "Midtown Urban" at The University of Texas at Arlington (UTA) in Arlington, TX.

investment portfolio highlights:

* Due to various risks and uncertainties, actual returns may differ materially from the returns reflected. No return is guaranteed and investors risk the loss of the entire amount of their invested capital. Offering Details Sourced From The PPM On Pages 6, 47, FORECASTED STATEMENT OF CASH FLOWS

Image of Students at TCU

why invest in student housing?

Student housing is a unique asset class in the real estate industry. It reflects multifamily but with demand drivers of residents wanting to live near/on their college campus. With college enrollment numbers nationwide increasing for the first time since the pandemic, student housing as an investment category warrants attention.

*Sources: www.doorloop.com, www.insidehighered.com

ABOUT Texas christian university - ‘horned frogs’:

TCU sits on a 302-acre campus in a tree-lined neighborhood in Fort Worth, TX. The University has experienced 20% enrollment growth over the past decade and is ranked the #2 Best Nursing School in Texas.

#1

Undergraduate Business School in TX

10,900

Undergraduate Student Population

NCAA D-1 Athletics

Big 12 Conference (Power 4)

Image of TCU Campus. School Data sourced from www.tcu.edu

about Texas christian university

‘horned frogs’:

#1

Undergraduate Business School in TX

10,900

Undergraduate Student Population

NCAA D-1 Athletics

Big 12 Conference (Power 4)

TCU sits on a 302-acre campus in a tree-lined neighborhood in Fort Worth, TX. The University has experienced 20% enrollment growth over the past decade and is ranked the #2 Best Nursing School in Texas.

Image of TCU. School Data sourced from www.tcu.edu

"Liberty Lofts" - TCU Student Housing

3517 South University Drive, Fort Worth, TX 76109

Images of Liberty Lofts Apartments

Freshman and Sophomore students are required to live in TCU dormitories. Liberty Lofts was developed in partnership with TCU to meet the growing need for apartment-style housing for Junior and Senior students not guaranteed on-campus housing.

The property leases fully furnished units and provides residents a pool, clubhouse, fitness center, gated parking, and a dog park.

investment highlights:

- Complex contains 55 three-bedroom units for 165 total beds

- TCU has a 5-year master lease for the exclusive right to secure all units for student housing through July 2028

- Located 0.5 miles south of campus, with school bus service available

- 100% occupancy as of 12/31/23

Liberty Lofts location relative to TCU Campus

ABOUT THE UNIVERSITY OF TEXAS AT ARLINGTON ‘MAVERICKS’:

#1

Largest Institution in the DFW Metroplex

28,000+

Undergraduate Student Population

NCAA D-1 Athletics

Western Athletic Conference (WAC)

UTA was founded in 1895 and is known for its affordability and it's highly ranked graduate programs.

The University has experienced 60% enrollment growth over the past decade and currently has 41,000+ students, the largest of any North Texas school and 5th largest in the state.

Image of UTA Campus. Data sourced from www.uta.edu

ABOUT The University of Texas at Arlington - ‘MAVERICKS’:

UTA was founded in 1895 and is known for its affordability and it's highly ranked graduate programs. The University has experienced 60% enrollment growth over the past decade and currently has 41,000+ students, the largest of any North Texas school and 5th largest in the state.

#1

Largest Institution in the DFW Metroplex

28,000+

Undergraduate Student Population

NCAA D-1 Athletics

Western Athletic Conference (WAC)

Image of UTA Campus. School Data sourced from www.uta.edu

Midtown Urban - UTA Student Housing

1121 UTA Blvd, Arlington, TX 76013

Images of Midtown Urban Apartments

UTA offers only 6,000 dorm beds and 5,300 off-campus beds – covering just 27.5% of the student body.

Midtown Urban is located adjacent to the UTA campus offering students a short walk or bus ride to classes, Greek Row and the Maverick Activities Center (MAC). The property leases fully furnished units and provides residents gated entry, a pool, clubhouse, fitness center, game room, and business center.

investment highlights:

- Four-story complex containing 70 two-, three-, or four-bedroom units for 232 total beds

- Located directly across the street from UTA's campus

- 95% occupancy as of 12/31/23

Midtown Urban's location relative to UTA Campus

Indication of Interest

Bridgeview DST Investment Programs are sold by broker dealers and registered investment advisors authorized to do so.

Contact your financial professional to learn more. Or, for help finding a financial professional please fill out the form below or contact BV at ir@bvcapitaltx.com for more information on 1031 DST Investments.

Disclosure

Investments in these securities are not suitable for all investors; they are speculative and illiquid and involve a high degree of risk and the potential loss of your entire investment. The information contained herein does not constitute an offer to sell nor a solicitation of an offer to purchase any security.

Offers will only be made through a private placement memorandum to accredited investors and qualified purchasers where law permits. Carefully review any private placement memorandum's “Risk Factors” section before investing. Moreover, you should not assume that any discussion or information in this fact sheet serves as the receipt of, or as a substitute for, personalized investment advice. Please remember that past performance may not be indicative of future results. For any tax questions, please consult a tax professional.

Consider the Risks:

An investment in the interests involves substantial investment and tax risks, including, without limitation, the following risks:

- The economic success of the interests will depend upon the results of operations of the property. Fluctuations in vacancy rates, rent schedules, and operating expenses can adversely affect operating results or render the sale or refinancing of the property difficult or unattractive.

- The Trust’s capitalization is supported solely by the cashflow from the underlying tenant lease. The sponsor is not under any obligation to contribute capital to the Trust.

- No assurance can be given that future cashflow will be sufficient to make the debt service payments on any borrowed funds and also cover capital expenditures or operating expenses.

- No assurance can be given that beneficial owners of interests will realize a substantial return (if any) on their investment or that they will not lose their entire investment in the trust.

- The interests are not freely transferable by the beneficial owners.

- There are various risks associated with owning, financing, operating, and leasing commercial properties in Texas.

- The interests do not represent a diversified investment.

- Beneficial owners must completely rely on the Trust to collect the rent and operate, manage, lease, and maintain the property.

- The interests do not represent a diversified investment.

- Beneficial owners must completely rely on the Trust to collect the rent and operate, manage, lease, and maintain the property.

- The beneficial owners have no voting rights with respect to the management or operations of the trust or in connection with the sale of the property.

- There are various conflicts of interest among the trust, the sponsor, the signatory trustee, and their affiliates.

- The interests are illiquid.

- There are tax risks associated with an investment in the Interests. Each prospective beneficial owner should consult with their tax advisor regarding an investment in the Interests and the qualification of the prospective beneficial owner's transaction under Section 1031 for their unique circumstances.

- There are risks related to competition from properties similar to and near the property.

- There may be environmental risks related to the property.

- There are various tax risks, including the risk that an acquisition of an Interest may not qualify as replacement property in a Section 1031 Exchange.

BV Capital is a member of the Bridgeview family of companies. BV Capital offers investments to existing private clients, broker dealers, registered investment advisors and family offices through BV Securities, member FINRA, as Bridgeview’s managing broker-dealer.

BV Capital is a member of the Bridgeview family of companies. BV Capital offers investments to existing private clients, broker dealers, registered investment advisors and family offices through BV Securities, member FINRA, as Bridgeview’s managing broker-dealer.