A triple net lease (triple-net or NNN) is a lease agreement on a property commonly found in commercial real estate. With a triple-net lease, the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance in addition to the cost of rent and utilities. Triple net leased properties have become popular investment vehicles for investors because they provide low-risk, steady income.

BV Archway Real Estate Income Fund

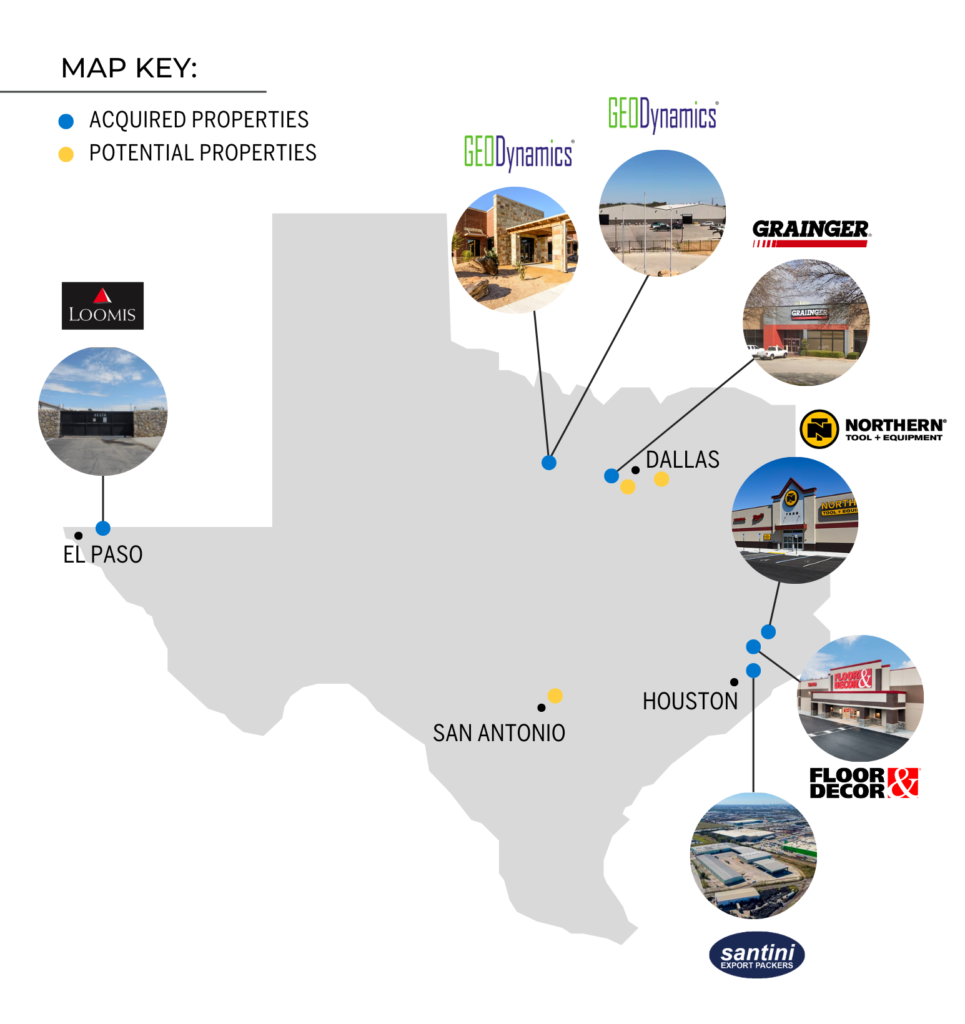

The BV Archway Real Estate Income Fund is a diversified portfolio of triple net leased (NNN) assets with a focus on Texas and Sunbelt States that have demonstrated resilience during the current economic environment.

The Fund is designed to be at least 70% to 80% Industrial in property type allocation with all assets being deemed essential and / or mission critical to the tenant. The Fund is designed to last 3-4 years effectively creating stable income for investors over that time frame with good upside potential at the end. At that time we will sell all the assets and return investor capital plus the profits from the sale.

Long term nnn lease

7%*

3-4 years

*The Preferred Return is not guaranteed as it relies on the performance of the Fund and the underlying assets.

fund Properties

GeoDynamics HQ

Greater Dallas - Fort Worth, TX

Acquired July 2021

Floor & Décor

Houston, TX

Acquired Feb 2021

Northern Tool & Equipment

Houston, TX

Acquired Nov 2021

GeoDynamics Machine Shop

Greater Dallas - Fort Worth, TX

Acquired Nov 2021

investment Criteria

Investment asset Criteria:

Overall Portfolio Criteria:

Why Invest in The Fund

BV Capital has a longstanding relationship with Archway Properties. Archway is one of the top developers and managers of Industrial properties across Texas. Eight properties have been acquired, with BV investors receiving monthly distributions since Feb 2021. The Fund is backed by a diversified portfolio of strong credit, single tenant, NNN leases (most leases at least 10 yrs vs. estimated fund duration of 5 yrs since breaking escrow in Feb 2021).

- 7% annual distribution paid monthly*

- $27 million raised to date, distribution payments began February 2021

- Monthly income for 3-4 years with upside at the end**

- Tax benefits -- annual K-1s + distributions coded as "return of capital for tax purposes only", so taxes are partially offset by coding the income this way.

- Diversification from ground up / value add real estate projects

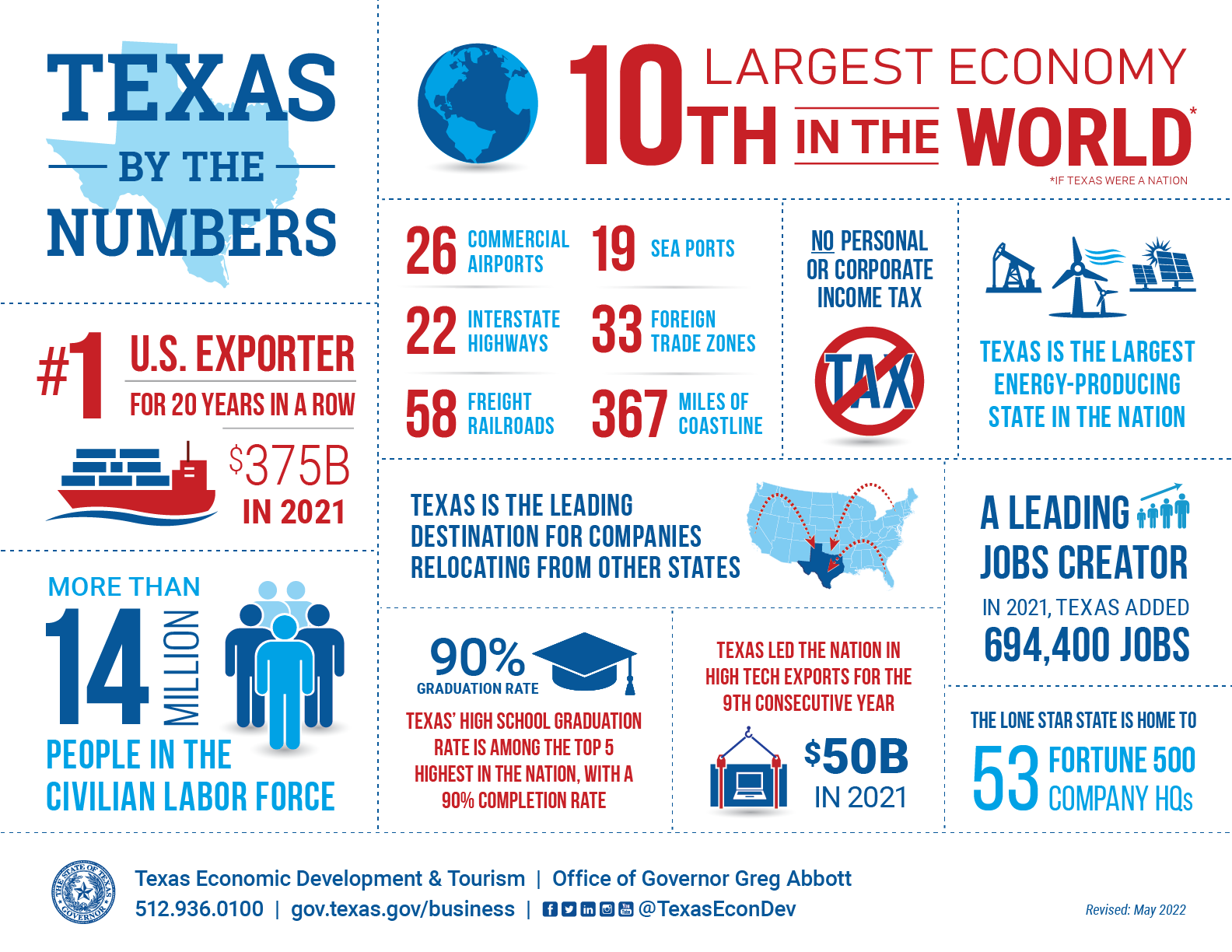

- Strong Texas economy combined with a new focus on US manufacturing / Industrial space, in line with reconfiguration of global supply chains and e-commerce

- $100k Minimum Investment

*Class A unit holders will receive distributable cash in proportion to their ownership of Class A units until they have received a cumulative, but not compounding, amount equal to 7.0% annual preferred return calculated monthly on each Class A unit holder's respective unreturned capital contributions for the applicable accrual period. The preferred return is not guaranteed as it relies on the performance of the Fund and the underlying asset.

**An investor should be able to withstand the fact that the return of their original capital contribution may be delayed. The Manager reserves the right to extend the five-year holding period for up to two additional years at the Manager’s discretion.

INVESTMENT THEMES

INDUSTRIAL

The Fund will favor Industrial properties and intends to create a portfolio of high-quality income generating Industrial assets in great locations with strong fundamentals.

SUNBELT STATES

Majority of investment is expected in Texas with the ability to find opportunities in other high growth states across the Southern US.

ESSENTIAL BUSINESS

The Fund will favor properties whose tenants were deemed “essential” and never closed operations during the COVID-19 shut down.

MISSION CRITICAL FACILITIES

The Fund seeks properties that demonstrate a “mission critical” nature to the tenant’s business. These companies have typically made significant investment in the facilities which makes relocation less likely.

BUILD TO SUITS

Archway's core competency. We expect business to continue to relocate facilities to Texas and other Sunbelt States due to favorable business climate, central location and affordable cost of living.

INVESTMENT THEMES

INDUSTRIAL

The Fund will favor Industrial properties and intends to create a portfolio of high-quality income generating Industrial assets in great locations with strong fundamentals.

SUNBELT STATES

Majority of investment is expected in Texas with the ability to find opportunities in other high growth states across the Southern US.

ESSENTIAL BUSINESS

The Fund will favor properties whose tenants were deemed “essential” and never closed operations during the COVID-19 shut down.

MISSION CRITICAL FACILITIES

The Fund seeks properties that demonstrate a “mission critical” nature to the tenant’s business. These companies have typically made significant investment in the facilities which makes relocation less likely.

BUILD TO SUITS

Archway's core competency. We expect business to continue to relocate facilities to Texas and other Sunbelt States due to favorable business climate, central location and affordable cost of living.