Triple Net Lease Investments

For generations direct real estate investing has provided wealth, but only for the select few. Historically, investors needed specific knowledge, the right connections and most importantly access to large amounts of capital. Hedge funds and professional investors have taken advantage of these opportunities for years, but now any Accredited Investor can participate in NNN investing.

Triple net leased properties have become popular investment vehicles for investors seeking steady income with relatively low risk. NNN properties are often considered a lower risk investment as they have a contractual lease in place with a business tenant, have minimal responsibilities for the landlord, and offer long-term passive income.

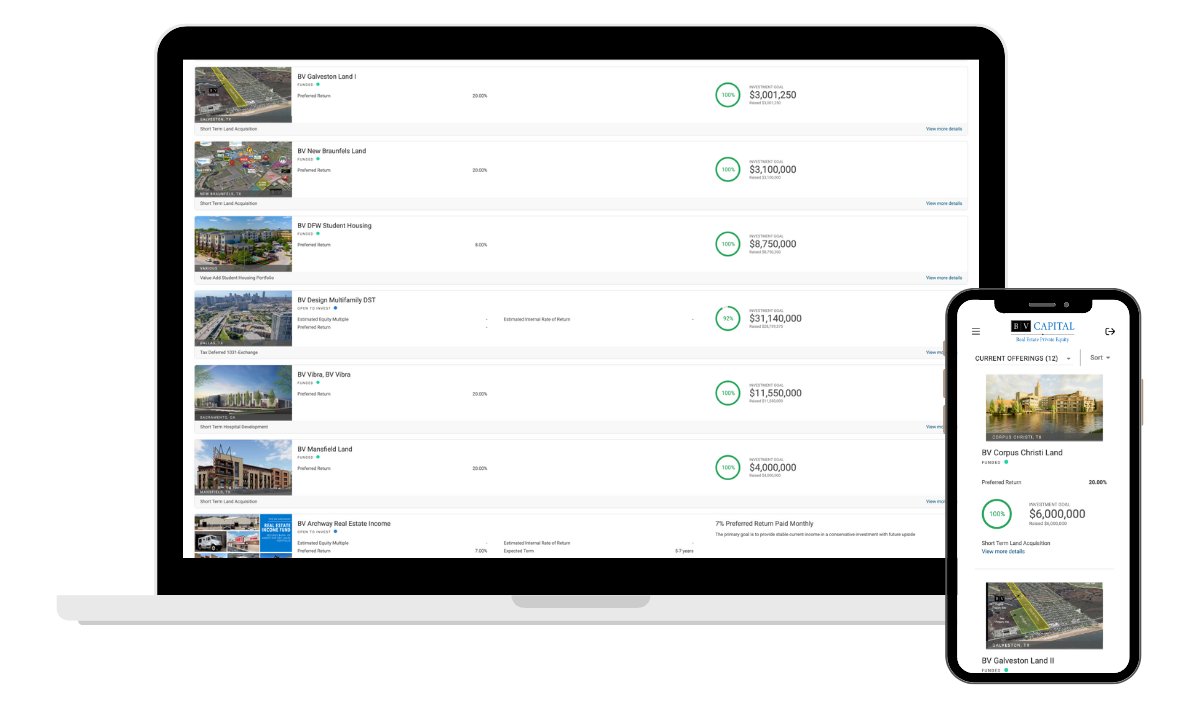

BV Capital offers a diversified fund of NNN industrial and commercial properties across Texas with the goal of producing monthly income for investors. View our Real Estate Income Fund Portfolio.

What is a NNN Lease?

A triple net lease (triple-net or NNN) is a real estate lease agreement where the ongoing expenses of a commercial property, including real estate taxes, building insurance, and maintenance are the responsibility of the tenant, not the investor or owner of the property.

Triple net lease investments typically consist of a single property or a portfolio of three or more high-grade commercial properties, fully leased by a single tenant with existing in-place cash flow.

Commercial properties could include office buildings, industrial parks, or free-standing buildings. The typical lease term for NNN properties is 10 to 15 years with built-in contractual rent escalation.

Each "N" in the "NNN" lease represents a net cost the building's operation expenses.

Under a triple net lease, the tenant is responsible for:

A Type of NNN Investment: Sale-Leaseback

The current environment also provides for sale-leaseback opportunities as good companies with long term operating histories are willing to sell company owned facilities to access capital for future growth and capital investment opportunities.

A sale-leaseback is a subset of triple net lease deals. In this type of transaction, the commercial property owner relinquishes ownership rights to the investor in order to gain liquid capital. Sale-leasebacks allow the seller to maintain control of company operations and lease back the property once the sale is complete.

In a good sale-leaseback the investor can confidently receive stable income from companies with a strong track record and commitment to the property.

BV Capital offers NNN investment opportunities through the BV Archway Real Estate Income Fund that offers investors an opportunity to participate in this asset class on a passive basis. Investors looking to generate cash flow without inheriting the duties and time commitment that come with being a typical landlord might consider triple net properties.

Contact us today to learn more about how we can help you grow your investment portfolio.

Why Invest in Triple Net Lease Properties

Many tenants desire to sign long-term triple net leases so they can keep control of the space where their businesses will be located and operated. While the tenant manages the solitary commercial real estate, the investor will collect their recurring monthly check without having to deal with the hassles that come with direct property ownership.

Triple net properties historically have been kept a well-guarded secret in the world of real estate investing with few people aware of the many advantages they hold for investors. The pricing transparency available today and the abundance of information accessible on triple net properties makes them attractive for a wide variety of investors.

The Benefits of NNN Investments:

NOTE: Depending on how the lease is structured in terms of landlord liability, the deal may be considered a triple net lease, but may not be an absolute triple net lease. In absolute triple net leases, the investor does nothing more than receive the monthly distributions.

The Drawbacks of a NNN investment

Finding the Right NNN Investment Opportunities

Finding which NNN investment opportunity to pursue is the biggest obstacle for investors looking to enter into this asset class.

Passive investors are continuously competing with more seasoned investors for access to the best triple net lease properties. This is a challenge for investors balancing job and family responsibilities. And with the high level of competition in the market, investors can easily lose out on opportunities, become overburdened, and quickly burnt out.

How to Evaluate a NNN Lease

The primary risk involved with a NNN lease is nonperformance by the tenant. It is crucial to vet the tenant(s) to ensure they will be in business for the duration of the lease. Look for assets with multiple exit strategies, and that the proper financial analysis and due diligence have been satisfied. NNN deals have certain commonalities across all sectors.

Whether you are considering a sale-leaseback or a general triple net lease, vetting the prospective tenant is the most important step to be taken by the investor.

1

Weigh business risk

Aside from the premium cost associated for a national brand within NNN properties, franchisee tenants represents more risk than corporate owners.

2

Inspect the lease thoroughly

Look for clauses that give the tenant a right to terminate the lease early, this is not a true long term triple-net deal and your 15-year contract may turn into a 5 year lease.

3

Check for loopholes that increase the investor's liability

In NNN leases the tenants are responsible for taking care of taxes, insurance, and maintenance, however certain structural repairs or expense costs fall outside of those categories, such as the roof.

Ultimately, who should invest in NNN Properties?

Investing in triple net properties provides you the opportunity to partake in an investment project while eliminating the expenses and time-consuming duties of managing the property yourself. In addition, NNN investments are generally considered less risky than value add or construction projects.

NNN investments can be unattractive for active real estate investors that want to work on the investment in order to boost returns because the income is capped by the terms of the lease. Whereas for the more passive investor, NNN projects are ideal as they are essentially turnkey commercial real estate investments.

Why Invest With BV Capital?

When it comes to NNN investing, BV Capital has years of experience in the industry and knows what it takes to find, acquire and manage NNN properties for investors. We are committed to treating our investor's money as our own and ensuring that our investors are comfortable every step of the way.

Our Investment Criteria

How To Get Started With NNN Investing

Check out the BV Archway Real Estate Income Fund

The Real Estate Income Fund is a diversified portfolio of triple net leased (NNN) assets with a focus on Texas and Sunbelt States that have demonstrated resilience during the current economic environment.

Give us a Call

Speak with the BV Investor Relations team to discuss your investing goals and risk tolerance preferences so we can help find an investment strategy appropriate for attaining your desired results. Contact us today to learn more about how we can help you grow your investment portfolio.