Article by: Ross Curtis, Vice President of Sales, BV Capital

One, if not the, most commonly uttered phrase of why an investor would consider adding direct real estate to their portfolio is “because it’s a hedge against inflation.” As inflation erodes your purchasing power, driving prices higher, your direct real estate values increase, keeping up with the current market. The adage “a rising tide lifts all ships” is a perfect analogy for the effect inflation has on real asset prices.

If you’re already an existing real estate owner it is great watching the value of your property rise with inflation. On the other side of the fence is the interested real estate buyer, trying to acquire in an inflationary/rising price environment. That is frustrating and leads to those in-head conversations of “Why didn’t I buy sooner” and “I shouldn’t have waited” because it costs more to buy now.

What else goes up during inflationary times? Interest rates.

Only makes sense for the cost of capital to rise alongside the asset prices, making it more expensive and restrictive to borrow money for a real estate acquisition. That’s why the Fed calls it a tightening monetary policy. So not only are those interested buyers upset that prices are up, if they get a loan to make the purchase, the cost for the debt is higher too.

This presents a very interesting dynamic on the buyer and seller front. You have real estate owners who are more likely to sell out at these higher prices and cash in. You also have interested buyers who want to purchase, but can no longer afford to. Transaction volume drops down and sellers can’t sell, buyers can’t buy, and the brokers in-between make no commissions. This is where we are now.

Two crucial points to remember in these times:

1. PAY ATTENTION TO THE DEBT TERMS

When investing into a syndicated real estate deal (with other investors), PLEASE look at the debt terms. The rate on the debt, the lock up period, the maturity date, the covenants, and the amortization or interest-only period. Why? Because your investment property owes that debt lender every month, and they get paid first.

Any revenue problems at the property level could cause steps towards the 'F word' – foreclosure. When capital costs are high, margin gets pressure. If revenues miss projections, margins get more pressure. That isn’t good for the equity investors. Look at the debt terms, look at the pro forma revenue assumptions, and understand your margin of safety in the deal. This is just one example as there are multiple risks associated with real estate investing, and the more you know about how your deal addresses those risks, the better.

2. Is it better to buy or build real estate?

Buy or build? While your desire may be to buy an asset now and start receiving cash flow immediately, today’s market environment proves challenging. Capitalization rates/yields have lowered while the associated risks are higher due to that margin of safety compression. If the risk/return ratio isn’t attractive enough, an option is to pivot to a new construction deal.

Since everything moves in cycles, when acquisitions face headwinds, development and construction are an option. Investors sacrifice immediate cash flow in the short-term, and focus on generating a higher IRR long-term between the cost of construction and future market value upon project completion.

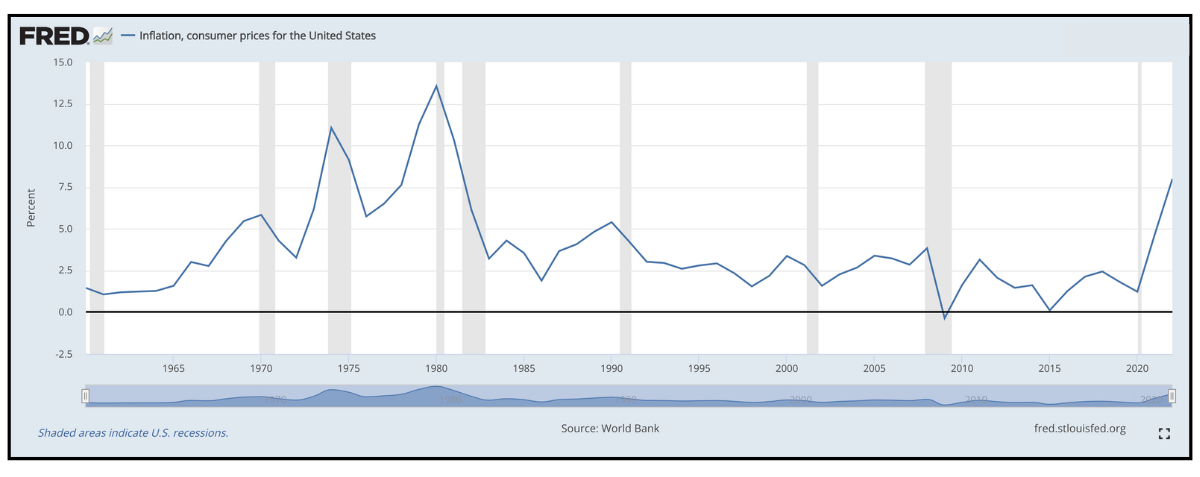

Remember, real estate prices may be elevated today, for how long no one knows, but inflation cycles typically don’t move very fast. The current up-tick trendline is the largest since the late 1970's per the St. Louis FED chart provided.

St. Louis FED Chart

in conclusion

If interest rates remain high or continue to rise, downward pressure will be placed on real estate prices (think of that inverse relationship between fixed income price & yield). With a higher cost of capital, price reductions should follow in order to meet demand and get transaction deals done. Alternatively, if and when interest rates fall, real estate valuations will rise again. Thus, the timeframe of any potential deal as it relates to the overall economic cycle should be evaluated. Construction deals today have the potential to exit in an entirely different economic environment.

Remember your investing options – buy vs. build – doesn’t have to be one or the other, as both strategies may fit well in a well-diversified real estate portfolio for the long-term.

featured open investment - ground up construction

BVCAP NB Investors New Braunfels

Bridgeview is ready to develop The Landhaus at Gruene, a new ground up construction multifamily property in New Braunfels, TX. The property will have 410 “Class A” garden style units in the third fastest growing city in Texas. New Braunfels is ideally located in between Austin and San Antonio. The project is estimated to take 36 months.