introduction

Imagine a savings strategy that allows you to pay significantly less in taxes now, while letting your investments grow completely tax-free for life. By leveraging unique opportunities in real estate development, you can convert your Traditional IRA to a Roth IRA at a reduced valuation. This means smaller tax bills today and greater financial freedom in the future. It's not just a tax-saving tactic – it’s a powerful way to amplify your retirement wealth without added complexity.

Benefits of a Roth Conversion

Converting your traditional IRA to a Roth IRA at a discount shifts the burden of taxation from your retirement years to now, often at more favorable rates. It’s particularly attractive for individuals who expect to see their investments grow significantly, who want flexibility in retirement, or who value leaving a tax-free inheritance.

1. Tax-Free Growth and Withdrawals

Traditional IRA: Contributions grow tax-deferred, but withdrawals in retirement are taxed as ordinary income.

Roth IRA: Contributions are after tax and grow tax-free, and qualified withdrawals are completely tax-free, allowing you to keep every dollar you earn.

2. Avoid Required Minimum Distributions (RMDs)

Traditional IRAs require you to start withdrawing money at age 73, whether you need it or not, potentially increasing your taxable income.

Roth IRAs have no RMDs, giving you control over how and when you access your funds.

3. Better for Estate Planning

Roth IRAs allow heirs to inherit funds tax-free, offering a more favorable legacy planning tool than a Traditional IRA.

4. Reduce Taxable Income in Retirement

Distributions from a Traditional IRA count as taxable income, which can push you into a higher tax bracket and increase taxes on Social Security benefits.

Roth withdrawals do not affect taxable income, allowing for more efficient tax management in retirement.

how it works

For high-income investors, the Roth IRA's advantages are clear but often frustratingly out of reach. While a Roth IRA offers tax-free growth, no required minimum distributions, and protection from Social Security benefit taxation, income limits typically prevent accredited investors from making direct Roth contributions. This leaves many sophisticated investors sitting on substantial traditional IRA balances, facing an uncomfortable choice: accept growing tax liability in retirement, or trigger a significant taxable event through a standard Roth conversion.

However, an innovative strategy involving real estate development projects offers a potential solution. By leveraging the natural investment valuation cycle of ground-up construction projects, investors may be able to execute Roth conversions at a substantial discount to their IRA's current value providing considerable tax savings and enhanced returns. Recent examples, such as BV Capital's New Braunfels development project, have achieved conversion discount rates of approximately 32% through carefully structured development investments.

This approach isn't simply about timing market fluctuations. Instead, it takes advantage of well-established valuation principles for development-stage projects, supported by independent third-party valuations and grounded in tax case law. For investors willing to understand its nuances, this strategy offers a sophisticated way to optimize the transition from traditional to Roth IRA status while potentially reducing the tax impact significantly.

A Strategic Alternative: The Development Project Approach

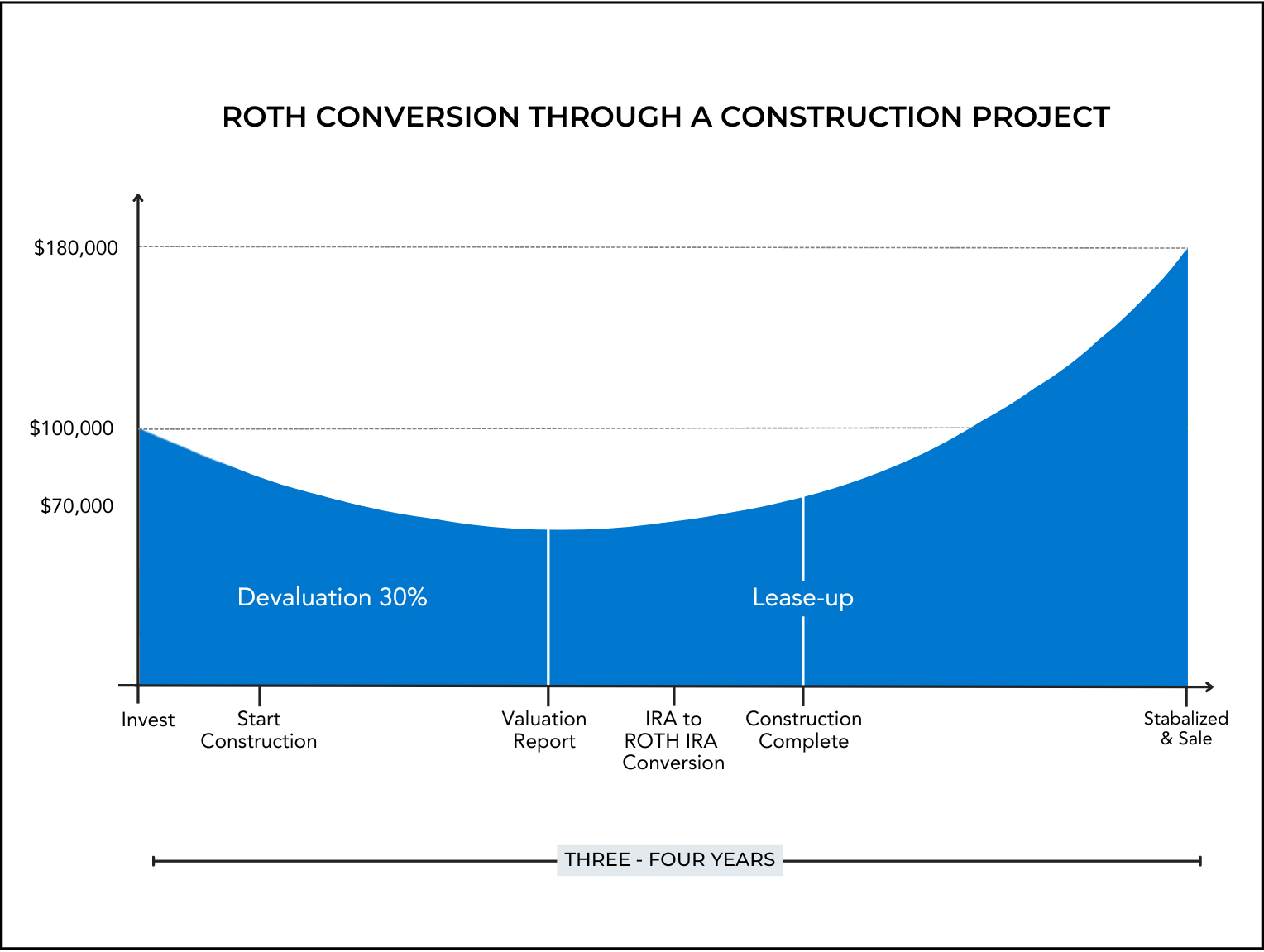

The mechanics of a development-based Roth conversion strategy become clearer when examining how real estate projects naturally evolve. Consider a typical ground-up multifamily development: when construction begins, the project enters what investment professionals call the "J-curve" period. During this phase, several factors combine to create a temporary but legitimate reduction in the project's market value.

This reduction stems from multiple documented factors. The investment becomes highly illiquid during construction. Transfer restrictions limit marketability. Initial development costs and fund-raising expenses must be absorbed. These elements typically result in a valuation discount of approximately 30% during the construction phase, as demonstrated by the New Braunfels project, where independent valuators documented a temporary 32% reduction from initial investment value.

To understand how this works in practice, consider an investor with a $100,000 traditional IRA investment in such a project. After construction begins and third-party valuators assess the investment, its documented value might decrease to $68,000. At this point, the investor can execute a Roth conversion based on this lower valuation. When the project later completes construction and achieves stabilization - typically within three to four years - its value often recovers and potentially appreciates beyond the initial investment amount, now growing tax-free in the Roth IRA structure.

Importantly, this strategy isn't about artificial devaluation. Rather, it recognizes legitimate economic factors that temporarily impact development-stage project values, supported by established valuation principles and documented by independent third-party assessments.

Understanding the Mechanics: The five Key Steps

Converting a traditional IRA to a Roth through a development project requires careful attention to process and timing. Each step builds on regulatory requirements while leveraging established valuation principles.

Here's how the process unfolds in practice:

The investor uses their traditional IRA to invest in a qualified ground-up development project.

The investor begins by using their traditional IRA to invest in a qualified ground-up development project. This initial investment is typically routed through a self-directed IRA custodian, as most traditional IRA custodians cannot accommodate private real estate investments. This first step requires no immediate tax consequences, as it's simply a repositioning of IRA assets.

an independent third-party valuation firm assesses the investment's current market value.

As construction commences, an independent third-party valuation firm assesses the investment's current market value. This isn't merely an appraisal of the underlying real estate - it's a comprehensive valuation of the investment position itself. PCE Valuations, for instance, analyzes factors including illiquidity discounts, lack of transferability, and initial investment costs. Their detailed methodology, as evidenced in the New Braunfels project, typically produces a valuation report spanning 30-40 pages and cites relevant tax case law supporting the discount rationale.

The IRA custodian receives and processes the third-party valuation report.

The IRA custodian then receives and processes this third-party valuation report. This creates an official record of the investment's reduced value - a crucial step for IRS compliance. For the New Braunfels project, this process documented a reduction from $100,000 to $68,000 per investment unit, reflecting both the development stage risks and restricted marketability of the position.

the investor can initiate the Roth conversion based on the newly established lower valuation.

At this point, the investor can initiate the Roth conversion based on the newly established lower valuation. This timing flexibility represents a significant advantage of the strategy. Investors can potentially spread their conversion across multiple tax years while maintaining the same discounted valuation, allowing for more nuanced tax planning.

construction completes and the property reaches stabilization

Finally, as construction completes and the property reaches stabilization, the investment typically recovers its value and potentially appreciates further. All future appreciation now occurs within the Roth IRA structure, free from future tax obligations.

What Makes This Work: The Economic and Legal Foundation

The effectiveness of this development-based conversion strategy rests on well-established economic principles and legal precedent. Unlike strategies that rely on aggressive tax positions, this approach aligns with standard valuation methodology accepted by both the IRS and financial markets.

The fundamental economic rationale stems from how development projects inherently create temporary illiquidity. When someone invests in a ground-up construction project, the investment becomes essentially locked for the development period. Independent valuators, such as PCE Valuations, quantify this illiquidity impact using established financial principles. Their analysis considers not just the theoretical basis for valuation discounts but also empirical evidence from secondary market trading of similar investments.

Recent market data supports these valuation principles. According to Jefferies' secondary market analysis, real estate fund interests typically trade at significant discounts to NAV during development phases, with recent transactions averaging discounts of 29% to 32% from stated values. This market evidence provides additional support for the discount rates applied in development project conversions.

The legal framework supporting these valuations is equally robust. Tax case law has consistently recognized that lack of control and marketability legitimately impact asset values. The valuation report for the New Braunfels project, for instance, cites multiple relevant court decisions and IRS rulings that acknowledge these principles. PCE Valuations' methodology specifically aligns with Revenue Ruling 59-60, which provides the foundational framework for valuing closely-held business interests.

However, proper structuring remains critical. The debt structure of development projects requires particular attention due to Unrelated Business Taxable Income (UBTI) considerations. Maintaining senior loan positions at or below 50% of cost, with preferred equity filling any remaining capital needs, helps minimize UBTI exposure while preserving the valuation discount rationale.

Important Considerations: Risk Management and Implementation

In executing a development-based Roth conversion strategy, sophisticated investors must carefully weigh several technical considerations that can materially impact outcomes. The most significant of these relates to Unrelated Business Taxable Income, a complex tax consideration that affects IRA investments in leveraged real estate projects.

UBTI becomes relevant because development projects typically utilize debt financing. When an IRA-owned investment generates returns partially attributable to borrowed funds, those returns may trigger UBTI taxation. The amount of UBTI exposure directly correlates to the project's leverage ratio. For example, if a project carries 50% debt when sold, approximately 50% of the gain could potentially face UBTI taxation at trust rates, which is currently 20% for capital gains.

However, this challenge can be actively managed through careful project structuring. We understand this and work to manage our senior loan LTV when possible. One of the ways we do this is by utilizing preferred equity for additional capital needs. This structure helps minimize UBTI exposure while maintaining the project's economic viability. In the New Braunfels case study, the projected exit leverage of approximately 35% significantly reduced potential UBTI impact.

Timing flexibility represents another crucial consideration. The valuation discount typically remains valid throughout the construction period, allowing investors to spread their conversion across multiple tax years while maintaining the same advantageous valuation. This flexibility enables more sophisticated tax planning, particularly for investors in variable income situations.

Finally, investors should understand that while independent third-party valuations provide strong support for the strategy, the IRS maintains general authority to challenge valuations. Working with experienced sponsors who maintain robust documentation and follow established valuation principles becomes essential for risk management.

Real-World Implementation: Taking Action

For investors considering this strategy, the path from concept to execution requires careful coordination among several key parties. The process typically begins with establishing a self-directed IRA relationship. Traditional IRA custodians generally cannot accommodate private real estate investments, making this initial step crucial. Once established, the self-directed IRA can participate in qualified development projects structured specifically for Roth conversion opportunities.

Timing becomes critical during implementation. In the New Braunfels example, we initiated the independent valuation process shortly after construction commenced, allowing investors to capture the optimal discount window. The formal valuation, conducted by PCE Valuations, provided comprehensive documentation supporting a 32% discount from initial investment value. This thorough documentation proved essential for IRA custodian acceptance and created a strong foundation for tax compliance.

Professional guidance plays a vital role throughout the process. While the strategy's mechanics are well-established, its complexity demands coordination between qualified tax advisors, investment sponsors, and IRA custodians. Even sophisticated tax professionals often benefit from detailed education we here at BV Capital provide, about the strategy's nuances, particularly regarding UBTI implications and valuation methodology.

The exit strategy also requires careful attention. The New Braunfels project demonstrates how proper structuring from the outset facilitates a clean exit process. The anticipated three-to-four-year development timeline aligns with optimal Roth conversion periods, while the targeted exit leverage of approximately 35% helps manage UBTI exposure through disposition.

For investors ready to proceed, the key first step involves identifying qualified sponsors with experience in Roth conversion-oriented development projects. These sponsors should demonstrate both development expertise and a thorough understanding of the strategy's technical requirements, particularly regarding valuation support and UBTI management.

Conclusion: Optimizing Retirement Planning Through Strategic Development

Real estate development and retirement account planning offers successful investors a powerful tool for optimizing their long-term tax position. While traditional Roth conversion strategies often require accepting significant immediate tax consequences, a real estate development based approach can show how careful structuring can meaningfully reduce this burden while maintaining full regulatory compliance.

The strategy's success relies on three key elements:

1. Proper project structuring to manage UBTI exposure,

2. Thorough independent valuations that follow established principles,and

3. Careful timing of the conversion process.

When these elements align, investors can potentially achieve Roth conversion discounts of 30% or more, supported by both market evidence and legal precedent.

However, implementation demands attention to detail and coordination among experienced professionals. The complexity of UBTI considerations, valuation requirements, and IRA custodian coordination makes working with experienced sponsors essential. Proper execution can create substantial long-term value for investors willing to understand and implement this sophisticated strategy.

For accredited investors seeking to optimize their retirement planning, this real estate development-based approach offers a compelling alternative to traditional Roth conversion strategies.

While not without its complexities, the potential to significantly reduce conversion tax liability while maintaining strong compliance support makes it worthy of serious consideration as part of a comprehensive retirement planning strategy. BV Capital can guide you through the process. Contact us here to learn more.