HUD-backed fixed-rate debt refers to long-term, fixed-interest rate loans for multifamily properties and other projects that are insured by the U.S. Department of Housing and Urban Development (HUD). These loans are often non-recourse, asset-based, and offer competitive rates, long amortization periods (like 40 years), and can include interest-only periods during construction, making them a reliable and stable financing option for developers and owners of apartment buildings and other housing projects.

Rendering video of future development

open offering: ground-up Development Project

BVCAP BELTON INVESTORS

Independent Senior Living and Retail Development Project – Corinth, TX

BVCAP BELTON INVESTORS LLC

Offering Overview

BVCAP Belton Investors LLC is seeking Class A membership interests of up to $12,000,000 in equity capital to facilitate the ground-up development of a 199-unit mixed-use Active Adult community located on approximately 6.50 acres in Corinth, Texas. This offering includes both equity and note investments.

The site is strategically positioned in Denton County along the high-growth Interstate 35 corridor, providing residents with direct access to the Dallas-Fort Worth metroplex. The combination of demand growth and constrained supply is ideal for an age-restricted community and supports long-term value creation for the Project.

The Belton benefits from HUD-backed fixed-rate debt, a premium active adult design, and a mixed-use setting in a high-growth North Texas corridor—all of which support durable cash flow and long-term value retention.

equity offering

$12,000,000

equity raise

$100,000

minimum investment

2.2x - 2.4x*

ESTIMATED INVESTOR multiple

8-10%*

PREFERRED RETURN

48-60 mo

EST. HOLD PERIOD

Note offerings

BVCAP Belton Investors A-1 Promissory Notes ( < $1,000,000)

Investor Return: 11% All-In*

Investor Income: 11% annual return paid in Monthly installments

Early Return of Capital

50% return of capital invested at final Certificate of Occupancy

50% of capital returned at asset stabilization

Estimated Time Frame: 48-60 Months

Minimum Investment: $50,000

BVCAP Belton Investors A-2 Promissory Notes ( > $1,000,000)

Investor Return: 12% All-In*

Investor Income: 12% annual return paid in Monthly installments

Early Return of Capital

50% return of capital invested at final Certificate of Occupancy

50% of capital returned at asset stabilization

Estimated Time Frame: 48-60 Months

Minimum Investment: $1,000,000

* Due to various risks and uncertainties, actual returns may differ materially from the returns reflected. No return is guaranteed and investors risk the loss of the entire amount of their invested capital. Preferred Return is dependent on share class owned.

estimated investment timeline

Bridgeview Multifamily LLC (the “Developer” or “Bridgeview”), an affiliate of the Sponsor, will be the manager of the Project Holding Company, and Bridgeview Construction LLC, an affiliate of the Sponsor, will be the general contractor for the Project Holding Company and is estimating to break ground in Q4 of 2025. The Project's total construction cost is estimated to be $62 million. Bridgeview Construction has “bid out” the entire project, with estimates that are within budget.

Investment Start Date

sep 2025

Construction Start Date

Q4 2025

Construction Length

22 Months

Investment Hold Period

4-5 years

The dates above are estimated timelines and are subject to change.

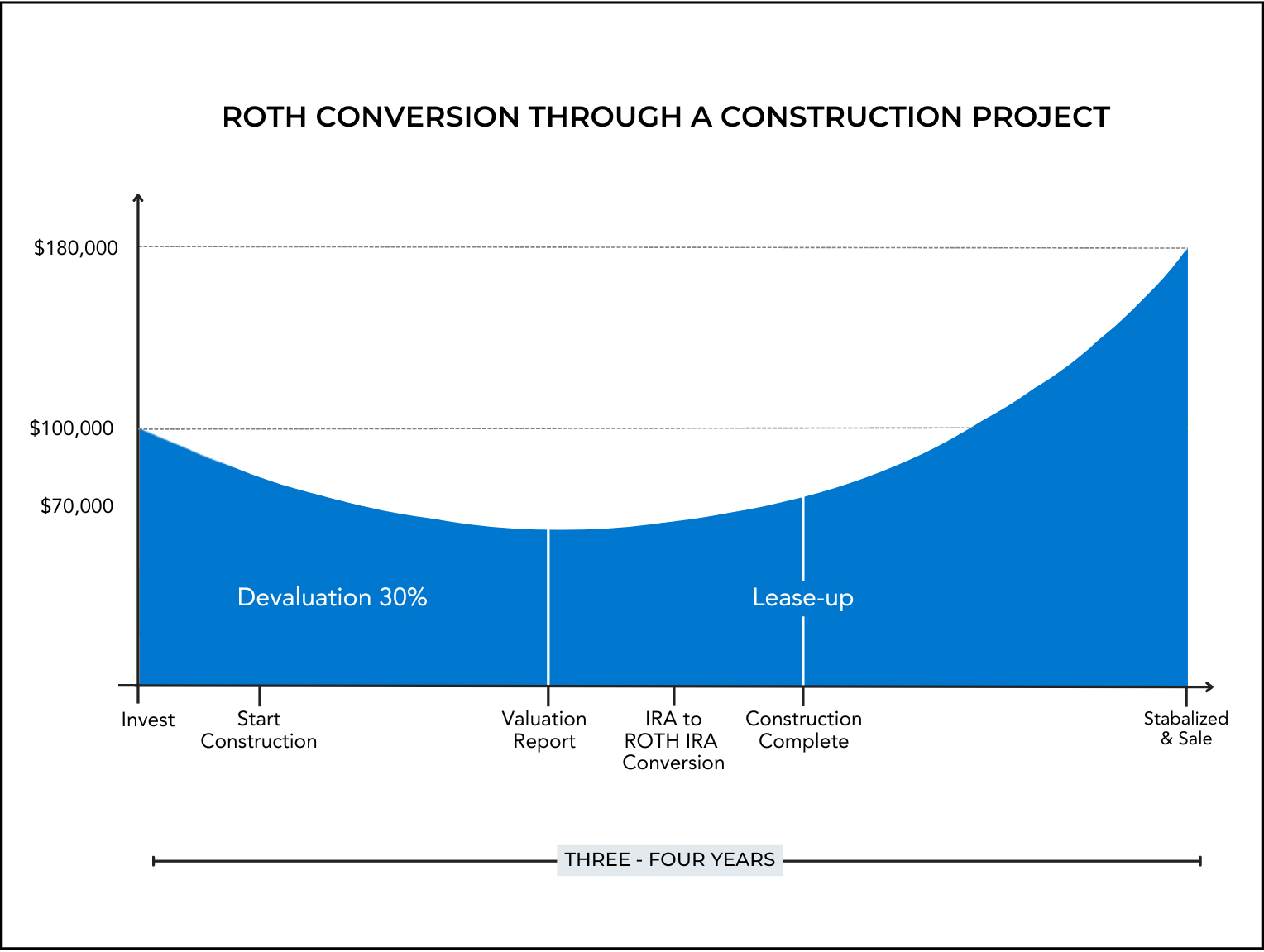

opportunity: convert your ira to a roth ira at a discount

Investors may be able to leverage the natural investment valuation cycle of ground-up construction projects to execute Roth conversions at a substantial discount to their IRA's current value, providing considerable tax savings and enhanced return.

When construction begins, the project enters what investment professionals call the "J-curve" period. During this phase, several factors combine to create a temporary but legitimate reduction in the project's market value. This reduction stems from multiple documented factors, and typically results in a valuation discount of approximately 30% during the construction phase, as demonstrated by the New Braunfels project, where independent valuators documented a temporary 32% reduction from initial investment value.

As construction is completed and the property stabilizes, the investment typically recovers its value and may appreciate further. All future appreciation now occurs within the Roth IRA structure, free from future tax obligations.

Chart for representational purposes only,

'THE BELTON'

3650 Corinth Parkway Corinth, TX 76208

Rendering of future development

199

2,000 SF

Project overview

an active adult mixed-use community

The Project will be named "The Belton", an age-restricted (62+) active adult community delivering 199 residential units—183 apartments and 16 duplex townhomes. The unit mix consists of 99 one-bedroom units, 84 two-bedroom units, and 16 two-bedroom townhomes, with an average unit size of approximately 1,018 square feet.

The Belton will feature Class A amenities including a clubhouse, crafts room, dining area, sunroom/library, golf simulators, media and game rooms, resort-style pool, men’s and women’s saunas, two pickleball courts, putting green, a large fitness center with group exercise space, catering kitchen, elevators, and a community garden. The site also includes approximately 2,000 square feet of leasable retail space.

COMMUNITY amenities

- Leasing Center & Clubhouse

- Crafts Room

- Dining Room and Catering Kitchen

- Sunroom/Library

- Fitness Room with Group Exercise Area

- Media and Game Rooms

- Resort Style Pool

- 2 Saunas

- 2 Pickleball Courts

- Putting Green

- Golf Simulators

the belton - corinth, tx

Project image gallery

All images displayed are artistic renderings of the future development.

Key Advantage

One of the most compelling features of this investment is the use of HUD 221(d)(4) financing—a non-recourse, fixed-rate construction-to-perm loan that offers unmatched leverage and long-term stability. HUD financing will cover up to 80% of total project cost, significantly reducing the required equity contribution and amplifying investor returns. The loan includes interest-only payments during the construction period, followed by a fully amortizing 40-year term, minimizing cash flow strain and eliminating refinance risk.

Additional benefits include:

- Fixed, low interest rates—often lower than bank or agency loans

- Fully assumable debt—creating a future selling advantage with minimal assumption fees

- Low DSCR requirement (1.18x)—supports higher proceeds compared to conventional lenders

- Non-recourse structure—limits investor downside and protects personal assets

- No need for preferred equity—HUD’s high leverage makes the capital stack simpler and more efficient

In today’s rising-rate environment and constrained credit markets, HUD 221(d)(4) financing provides institutional-quality debt that enhances project feasibility, reduces execution risk, and supports superior long-term investor outcomes.

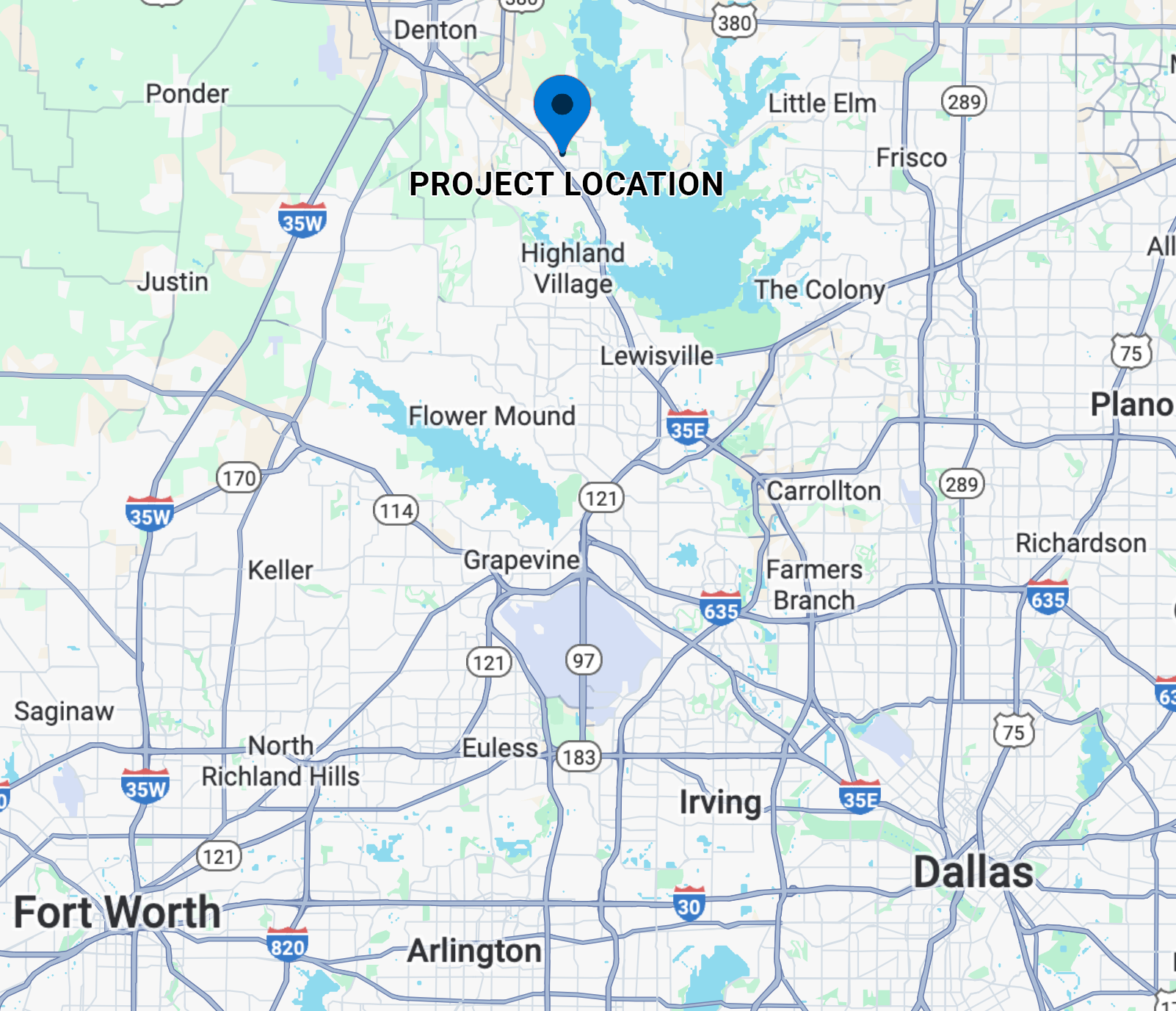

project location: denton county, TX

Bridgeview believes one of the key drivers of strong projected returns is the exceptional location. Corinth, Texas is located within Denton County, an area experiencing significant population growth but with limited new active adult (55+) supply.

The site is strategically positioned along the high-growth Interstate 35 corridor, providing residents with direct access to both Denton and the broader Dallas-Fort Worth metroplex. Surrounded by expanding retail, healthcare, and recreational amenities—including a new city park and amphitheater.

This combination of demand growth and constrained supply supports long-term value creation for the Project.

- Denton County experienced a population growth rate of 2.89% in the past year

- Corinth has a Median Household Income of approximately $117k

- Diverse and Financially Stable Economic Base in Metro

- Location provides Ease of Access to Major Highway Interstate-35

- Located less than 40 miles from both Fort Worth and Dallas

Sources: worldpopulationreview.com

Project's location among the DFW Metro

a look into the active adult investment class

Active Adult properties are age-restricted, market-rate multifamily products with a lifestyle-focused approach not a care-focused senior living model. These properties bridge traditional housing and senior living, offering amenities, social engagement, and a sense of community to older adults seeking a lifestyle change without the burdens of homeownership.

As both Texas and the U.S. experience accelerated aging population trends the demand for quality, maintenance-free rental housing tailored to 55+ households is rising sharply.

Why invest in Active Adult?

- Aging Baby Boomer population: The aging of the enormous Baby Boomer generation creates a powerful demographic "tailwind" fueling demand for years to come

- Low Supply: As of 2025, the Active Adult sector has penetration rates of 0.5% to 1% nationally, significantly lower than traditional senior housing properties (around 11-12%)

- High occupancy rates: The active adult segment consistently hovers in the low-to-mid-90% range

- Longer Lease Terms: Averaging 6-9 years

- Lower Operating Costs: Compared to assisted living or memory care, active adult communities have lower operational costs and staffing requirements, leading to more favorable investment metrics

Sources: NIC

indication of interest

Please fill out the form below or contact BV at ir@bvcapitaltx.com for more information on the BVCAP BELTON INVESTORS LLC offering.

the developer

Bridgeview Real Estate

Bridgeview has an established track record of developing over 1,000 multifamily units and renovating an additional 1,000 units. Combined, Bridgeview’s principals have been involved in the development, acquisition, renovation, and disposition of almost 9,000 multifamily units and 1 million square feet of commercial space as well as other real estate transactions in all, totaling more than $3 billion.

Multifamily Developments built by Bridgeview

14 ASSETS

Fully Realized

+420M

Total Capitalization

34.7%*

Average Investor IRR

2.91x*

Average Investor Multiple

2,385

Units Sold

1,323

Units Developed

2,464

Units in Pipeline

36 Mo.

Average Hold Period

*Past performance is not indicative of future results. There is no guarantee that the Sponsor will be able to execute similar investments and investors risk the loss of their entire investment.